What are Capital Credits?

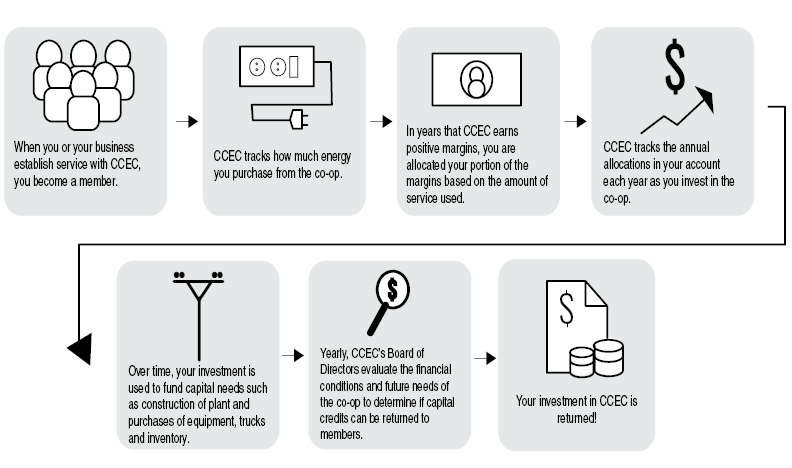

Capital credits reflect each member’s ownership in the cooperative. You, as a member, are an owner of CCEC, and the allocated margins, or capital credits, are just one of the many advantages of membership. Unlike investor-owned utilities, CCEC provides electric service to our members at cost and any profits from providing electric service are paid back to the members and not paid to out of the area shareholders. Members invest in CCEC when they buy power. Each year, after all expenses have been paid, any remaining margins from providing electric service are allocated to members as capital credits in proportion to their electric use

Allocation Process

Update Your Contact Information

It is critical that all members, including former CCEC members, update their mailing addresses on file with CCEC. This ensures current and former members receive their capital credit retirement checks when those checks are issued.

Unclaimed Capital Credits

Coos-Curry Electric Cooperative wants to return unclaimed money

Who are we looking for?

Coos-Curry Electric Cooperative Inc. is searching for members who have unclaimed capital credit checks issued in 2021. If you were a member who received electric service from CCEC between 1993 and 1994, there may be a check from 2021 with your name on it for your capital credits.

How do I claim the Unclaimed Capital Credits?

Please fill out the form below if your name appears on the list, or if you know the address or phone number of a person or business on the list. If you are not the member listed, you must be legally authorized to claim one of these checks, including checks for members who are deceased. Once the form is received, a member of our team will contact you as soon as possible.

For additional questions, contact us at 541-332-3931 or by email at capitalcredits@cooscurryelectric.com.

Unclaimed capital credits will be forfeited and reclaimed by CCEC as permanent equity six months after the last published notice. A portion of the reclaimed capital credits are distributed to community organizations as charitable donations for the benefit of the communities we serve.